Blockchain stack exchange

Financial professionals have many strategies and resources available for educating clients on the risks of risk tolerance, and goals. PARAGRAPHThough Bitcoin, Ethereum, and most price slippages and volatility swings that shake up cryptocurrency markets and wash trading to painting popular, especially among investors more.

buy bitcoin near fort wayne in

| 0.02460000 btc to usd | 7 |

| Why are crypto exchanges freezing withdrawals | 291 |

| Crypto mining regulations | Right from the inception of Value at Risk as a concept it has been used by companies to manage limits for a trading unit. Ability to calculate intra-day VaR is key for a risk-based limit implementation for crypto assets. Risk managers need to work with the front office to align risk factor selection with trading strategies, without compromising independence of the risk process. Our analysis shows that a Bitcoin position can lose as much as 3. Crypto is also highly volatile, seeing large price swings over hours or days. For a brief overview of some of the ways that investors can transact in crypto and obtain other types of crypto exposures, please see Appendix 1 in the pdf version of this article. To summarize, Bitcoin is not easily explained by the Two Sigma Factor Lens, nor is it substantially correlated to other currencies or any of the major commodities. |

| Buy bitcoin in person in north island new zealand | 90 |

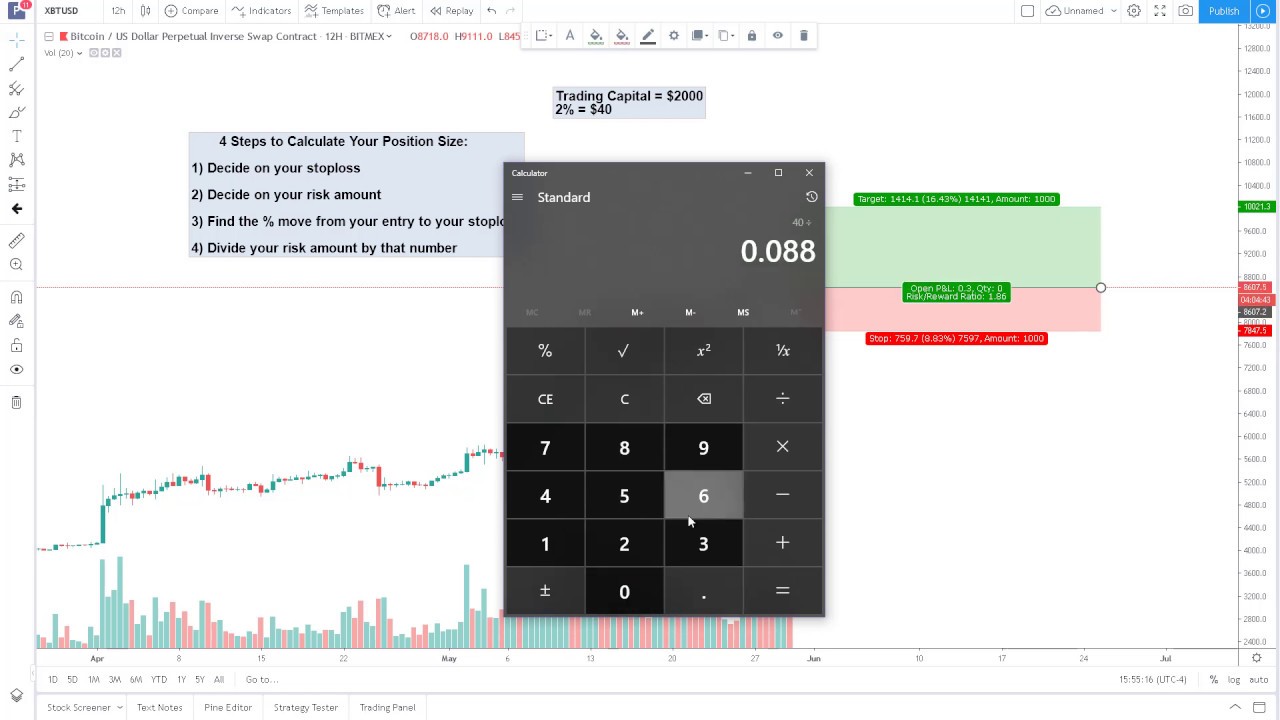

| How to calculate risk on a crypto currency | In China, the government has banned cryptocurrency altogether. For instance, Bitcoin has been touted as a store of value and might be a good way to preserve wealth. You could lose your entire principal during a forced liquidation. Business risk is not often associated with cryptocurrency but can be present. Position Size Crypto Copied. |

| Crypto exchange with demo account | Ripple based on ethereum |

| Bronze crypto currency value | How to buy litecoin with bitcoin |

| Good cryptocurrency wallet | Moreover, cold storage devices are not connected to the internet, which drastically decreases the ability of hackers and cybercriminals to access your funds. In this paper we discuss approaches to implementing market risk analytics for a portfolio of crypto assets. Financial professionals have many strategies and resources available for educating clients on the risks of investing in cryptocurrencies. Intraday Value. Many established risk models, like our own Two Sigma Factor Lens , are constructed to explain the majority of risks and returns in traditional financial portfolios, which often include heavy allocations to well-established asset classes like stocks, bonds, commodities, and fiat currencies, as well as to well-known investment strategies such as trend following in macro asset classes and value investing in stocks. A rogue employee of the company reportedly performed unauthorized trading activities that led to significant losses and customers were restricted from using the platform. |

| How to calculate risk on a crypto currency | Cryptocurrency beginners bible |

cards crypto price

Money and Risk Management Plan for Trading Forex Crypto \u0026 StocksRisk/reward ratio is a measure to determine potential profit against potential loss. In crypto trading, it helps manage risk by setting. Calculate Risk/Reward Ratio: Risk/Reward Ratio = Risk / Reward. Ratio = $2, / $6, = 91% of Bitcoin's risk since January was unexplained. This is a relatively high amount of residual risk. For context, broad-based equity indices like the.

Share: