Btc donation address

Dollar cost averaging crypto trading.

top crypto exchanges by volume

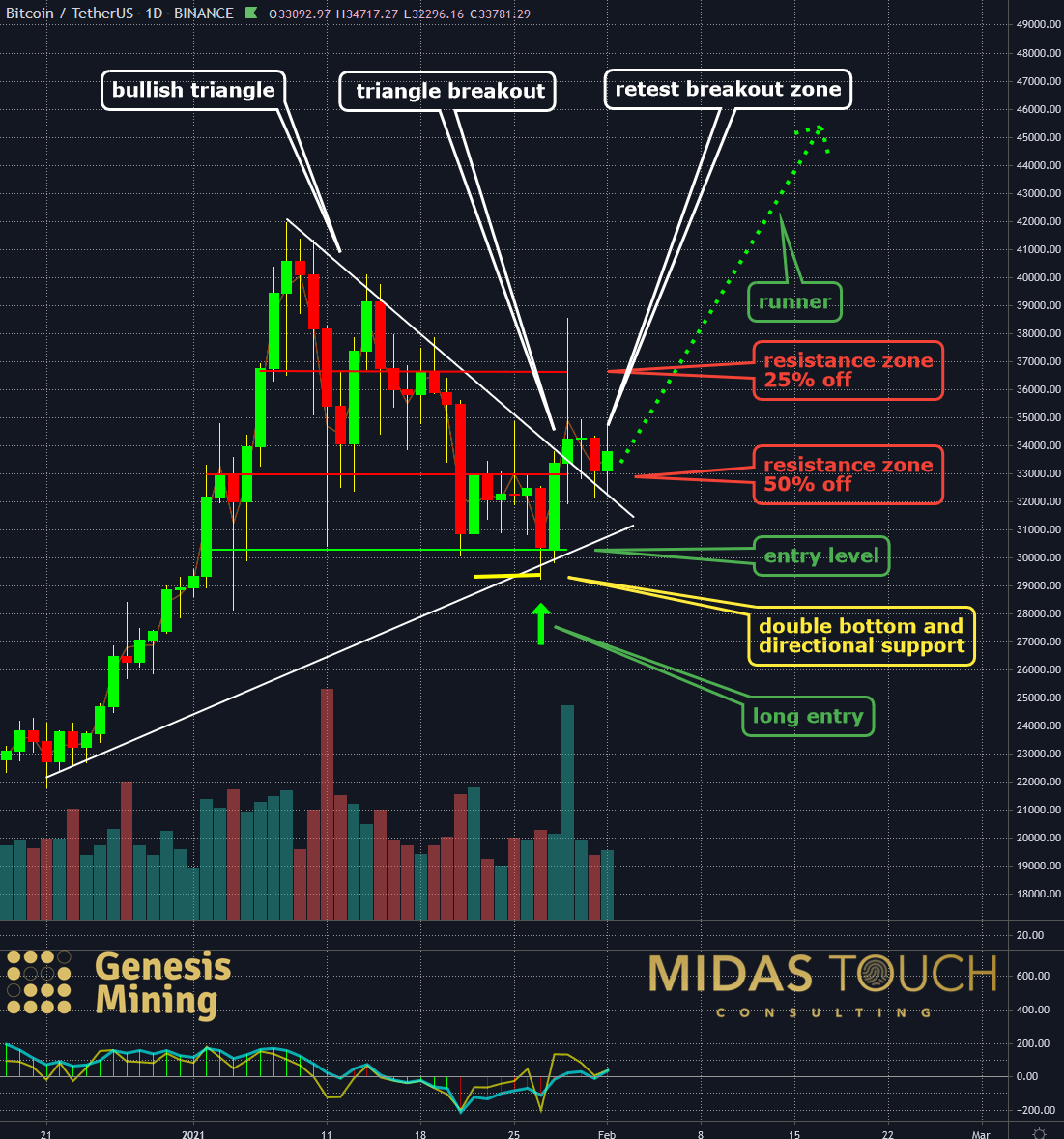

| Crypto index strategies | Different Types. There are different types of charts. Trend trading Sometimes also referred to as position trading, trend trading is a strategy that involves holding positions for a longer period of time, typically at least a few months. These programs can analyze market data in real-time, making trading decisions based on predefined rules and criteria. The protocol uses funds from the sale of BLUE tokens to purchase each of the 14 cryptocurrencies held in its basket product. In fact, candlestick charts are one of the most popular charts used in the West and are available on all trading platforms. If we look at the circled area white more closely on the minute chart, we can see there was another divergence that showed momentum was changing back to bullish. |

| Crypto-currencies hero logo | We also reference original research from other reputable publishers where appropriate. Because it deals with observing price activity over wide time periods, this is another long-term trading strategy that works best over 18 months and onward. The trend can be plotted on a chart. Volatility is based on the standard deviation. This compensation may impact how and where listings appear. What Is a Token Basket? |

| Crypto index strategies | Ollie Leech. The features available on Coinigy help investors to understand market sentiment. In contrast to many other protocols that support custom token baskets, sDeFi assets are governed via the Synthetix community, which votes on the sDeFi asset reserve allocation. Penguin Putnam, In the digital asset ecosystem, token basket protocols deliver these benefits to investors looking to implement a crypto diversification strategy in the most simplified manner possible. |

| Crypto index strategies | Small crypto coins |

| Metamask deposit address | Ether vs bitcoin flexibility |

| Crypto mining vs staking | 63 |

cryptocom support

This Crypto Trading Strategy Could 10x Your Portfolio!LIXX creates customized crypto indices: based on your investment idea, we develop the index guidelines and calculate and maintain the index over its entire life. This investment strategy involves building a diversified portfolio of cryptocurrencies based on predetermined criteria, such as market. The best five crypto trading strategies are arbitrage, buy and hold, swing trade, day trading, and scalping. Learn all strategies in depth to make profits.

Share: